The minimum deposits we allow are 200$ or 200€ or equivalent in other currencies.

Please note that for certain assets such as Stocks, Shares and Indices we recommend a minimum of 2.000$ or 2.000€ or equivalent in other currencies, in order to be able to withstand the rapid price movements on these volatile markets.

EqualFX offers the VIP account type with RAW spreads for ALL tradersregardless of the size of their deposit.

We always offer you the RAW spreads the same as we receive, without any Mark-Up!

Hence these are the best conditions available directly from the InterBank-Market thanks to the Deep Liquidity from our Tier1 Providers.

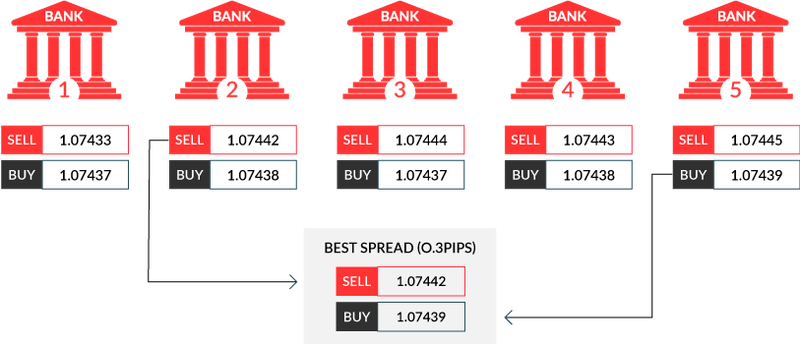

Using our Price Aggregator we acquire the price feeds from all our Tier1 Liquidity Providers.

Then by using our Automated NDD setup we can pair the spread quotes from different LPs and thus offer our traders the best existing conditions.

see the image below

EqualFX uses STP/ECN technology moreover, we are categorising ourselves as a No Dealing Desk (NDD) Broker.

This means that trades are processed Automatically without human intervention.

Meanwhile, many Brokers claim to be STP/ECN while having a Dealing Desk.

Simply because STP (Straight Through Processing) and ECN (Electronic Communication Network) are merely referring to a technology that is available for ALL brokers.

However, NDD not only means the usage of STP/ECN technologybut also signifies that there is No Conflict of Interest between Traders and the Broker.

Besides the RAW spread and SWAP costs, there is a commission that is charged for each round-turn lot.

Round-turn means an Opened and Closed transaction.

The commission is charged at the opening time and nothing is charged at the closing.

For Shares, we only charge 0.08 USD / share (or equivalent in other currency).

For all other instruments; FX pairs, Indices, Cryptos, Metals, and Commodities we only charge 5 USD / lot (or equivalent in other currency).

If you trade fractional lots then a fraction of the commission amount will be charged.

i.e.: When you open and close a trade of 0.2 lots on EUR/USD your commission will be only 5 USD x 0.2 = only 1 USD for this transaction

Margin Requirement is the amount of available money (equity) that is needed in order to open a particular trade.

For each asset class there are different margin requirements:

See the below examples:

Example #1:

If you wish to open 1 lot(1 lot = 100.000 currency in this case GBP) of GBP/USD

at the exchange rate of 1,40900then the value of this trade is 140.900, 00 USD (trade size * exchange rate).

The margin requirement is 0.2% of the value of the trade, which is 281, 80 USD.

This amount has to be available on the account before opening the trade.

If the base currency of the trading account is different, then this amount has to be converted.

Example #2:

If you wish to open 100 lots(1 lot = 1 share) of Microsoft Corp (MSFTUS)

at the exchange rate of 210,25 USD then the value of this trade is 210.250, 00 USD (trade size * exchange rate).

The margin requirement is 1% of the value of the trade, which is 2.102, 50 USD.

This amount has to be available on the account before opening the trade.

If the base currency of the trading account is different, then this amount has to be converted.

Example #3:

If you wish to open 1 lot(1 lot = 10 units of the index) of DAX (D30EUR)

at the exchange rate of 13.400,00 EUR then the value of this trade is 134.000, 00 EUR (trade size * exchange rate).

The margin requirement is 2% of the value of the trade, which is 2.680, 00 EUR.

This amount has to be available on the account before opening the trade.

If the base currency of the trading account is different, then this amount has to be converted.

Example #4:

If you wish to open 1 lot(1 lot = 100 oz) of Gold (XAU/USD)

at the exchange rate of 1.900,00 USD then the value of this trade is 190.000, 00 USD (trade size * exchange rate).

The margin requirement is 1% of the value of the trade, which is 1.900, 00 USD.

This amount has to be available on the account before opening the trade.

If the base currency of the trading account is different, then this amount has to be converted.

Example #5:

If you wish to open 1 lot(1 lot = 10.000 mmBtu) of Natural Gas (XNG/USD)

at the exchange rate of 2,515 USD then the value of this trade is 25.150, 00 USD (trade size * exchange rate).

The margin requirement is 2% of the value of the trade, which is 503, 00 USD.

This amount has to be available on the account before opening the trade.

If the base currency of the trading account is different, then this amount has to be converted.

Example #6:

If you wish to open 0.01 lot(1 lot = 100 coins) of Bitcoin (BTC/USD)

at the exchange rate of 32.515,20 USD then the value of this trade is 32.515, 20 USD (trade size * exchange rate).

The margin requirement is 10% of the value of the trade, which is 3.251, 52 USD.

This amount has to be available on the account before opening the trade.

If the base currency of the trading account is different, then this amount has to be converted.

No.

The Share instruments are CFD products based on the Global Stock Exchange prices.

EqualFX offers Contract for Difference (CFDs) products that pay out the difference between the value of an instrument at the time of opening a position, and the value of the instrument at the time of closing a position - this is where profit and loss are derived from.

CFDs on Shares or Stocks have no rights for ownership or dividends.

The same principle applies to FX pairs, Indices, Cryptos, Metals, and Commodities.

We do not enforce restrictions on your trading methods or strategy.

You’re welcome to use any trading methods you desire!

However please be sure to understand that EqualFX does reserve the right to refuse its service to any trader who engage in unethical behavior, fraud, software manipulation, arbitrage, or any unmentioned illegal activity.

A color copy of a valid passport or other official identification document issued by authorities e.g. driver's license, identity card, etc.

The identification document must contain the client's full name, an issue or expiry date, the client's place and date of birth or tax identification number, and the client's signature.

A recent utility bill (e.g. electricity, gas, water, phone, oil, Internet and/or cable TV connection, bank account statement) dated within the last 6 months and confirming your registered address.

As per Inretbank Regulations also per Anti-money laundering and counter-terrorist financing guidelines we are required to collect the personal information of our customers. The on-boarding process involves the collection of adequate information in form of questions from our traders with regards to KYC (Know Your Client) procedures, moreover the collection of valid identification and a recent proof of residence that confirms the address the client has registered with also mandatory.

No, your new account will be validated automatically, as long as you will use the same personal /contact details as for your previous account.

MT5 or Meta Trader 5 is the latest generation software for online trading. You may use it on your PC, Android or IOS mobile or tablet device.

Available in over 30+ languages and suitable for both Live and Demo accounts, MT5 is a market leading platform and the future of trading.

Simply put; we wish to provide our traders with the very latest technology.

Following the great success of MT4, MetaQuotes designed its ultimate successor the MetaTrader 5.

Whether you’re new to trading or more experienced, if your driving desire is to succeed in the markets MT5 platform is for you!

While MT4 allows only hedging, however MT5, permits both hedging and netting.

An example of netting is; if a trader is opening a long position for 1 lot on say the EUR/USD and then enter a second 1 lot in the same instrument and same direction, the initial order entry would simply become one position, as opposed to two separate positions.

On the other hand if the second position is the opposite direction, than the two positions would cancel each out.

- MT5 is faster and more efficient than MT4. MT5 is a 64-bit, multi-threaded platform, whilst MT4 is a 32-bit, mono-threaded platform.

- MT5 have more Time Frames, total of 21

- MT5 have more types of Pending orders, total of 6

A Pip, short for "percentage in point" or "price interest point," represents a tiny measure of the change in a currency pair in the forex market.

It is usually $0.0001 for U.S.-dollar related currency pairs, which is more commonly referred to as 1/100th of 1%, or one basis point.

1 Pip = 10 Points thus, a Point is 1/10th of a Pip.

For example,

The Pip Size is a number that indicates the placement of the Pip in a price.

For most currency pairs it is a standard value of 0.0001.

For example, the Pip Size for EUR/USD is 0.0001.

This means that if we look at the price of EURUSD at any given point in time, the 4th place after the decimal point is the Pip. Thus, the Point is the 5th place.

There are instruments that have a Pip Size of 0.01, for example, XAG/USD.

This means that for XAG/USD, the Pip is the second digit after the decimal point, and Point the third.

The most common risk management tools in Forex trading are the pending orders.

These can be Take Profit, Stop Loss, Buy Limit, Sell Limit, Buy Stop, or Sell Stop orders.

A stop loss order sets a particular position to be automatically liquidated at a predetermined price in order to limit potential losses should the market move against an investor's position.