The EqualFX Alarm Manager is an essential trading assistant. It was developed both for hobby traders and also for professionals and educators who want to share important, trade-relevant information with their followers.

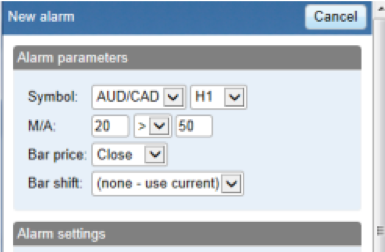

Traders can create custom alarms based on simple or even complex rules which can trigger multiple different actions at the same time. This tool can notify the trader about events, carry out trading actions such as placing new orders, closing existing positions, or send updates to followers via E-mail, SMS even Twitter.

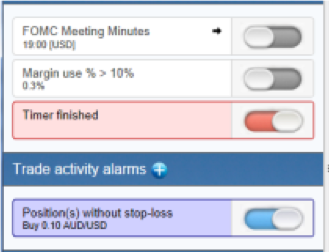

These are the available alarms for the main events during trading:

These are the available actions once an alarm being triggered during trading:

For example, you can set up a very complex algorithm with the Alarm Manager:

The EqualFX Correlation Matrix is a tool to manage risk and provides the trader with more insight. The app shows a grid of the correlations between the selected assets or instruments. Providing a complete overview of all the available possibilities to the trader by allowing a calculation of the correlation of metals and shares, even indices against forex currency pairs. (For a detailed analysis of the correlation between any symbols, traders can download the EqualFX Correlation Trader app!

The matrix is displaying not just numeric values (between -100 to +100) but also using a simple colour-coding to help our traders identify strong or weak correlations immediately. The strong correlation is marked in red because traders will typically want to avoid it - or trade with those assets carefully when those strongly correlate against each other.

The investors can change the mode of the calculation by choosing a different timeframe also by selecting a different number of historic bars, depending on what they feel more appropriate for their style of trading.

Highlighting strong or weak correlation

The app allows the traders to highlight sub-sections of the grid e.g. isolate the symbols which strongly or weakly correlate with or against each other.

"What if?" scenarios

The app can calculate the average correlation between all the instruments in which the investor has an open trade. The app also lets the trader select any group of assets and then calculates the average correlations between them. This allows you to analyse the risk level of a selected portfolio of trades.

About the correlation

Correlation can have a strong effect on your trading risk. For example, if EUR/USD and USD/CHF are strongly correlated for a few days, if you decide to open positions in both, you would have very similar profits on each trade. On the other hand, if you choose two assets that are strongly correlated against each other for a few days and decide to open a position on both at the same time and the same direction then the profits and losses would most likely cancel each other out.

It is generally advisable for a trader to minimise the correlation between their open positions. Otherwise, they are either trading the same price action twice over, or they have two positions that largely cancel each other out.

The EqualFX Correlation Trader takes the data from the EqualFX Correlation Matrix and expands on it so that you can trade on the real-time correlations between two symbols of your choice. The EqualFX Correlation Trader also shows the investor not only the current correlation but also shows the price activity in the past, thus helping the trader to make informed decisions.

Investors choose the EqualFX Correlation Trader app for two reasons:

You may choose any timeframe on the charts in combination with the current correlation, to spot the tradeable differences in the relationship between symbols. For example, if the correlation shows a strong relationship between EUR/USD and USD/JPY, but the latest price changes suggest a break-out in this relationship, then you could conclude that this is a trading opportunity.

The EqualFX Correlation Trader includes a deal ticket for opening positions directly from the app, so you don't need to go back to the chart.

The EqualFX Correlation Trader app can also be used as an easy method to display two asset prices next to each other, also showing the current open positions and profits for each instrument.

About the correlation

Correlation can have a strong effect on your trading risk. For example, if EUR/USD and USD/CHF are strongly correlated for a few days, if you decide to open positions in both, you would have very similar profits on each trade. On the other hand, if you choose two assets that are strongly correlated against each other for a few days and decide to open a position on both at the same time and the same direction then the profits and losses would most likely cancel each other out.

It is generally advisable for a trader to minimise the correlation between their open positions. Otherwise, they are either trading the same price action twice over, or they have two positions that largely cancel each other out.

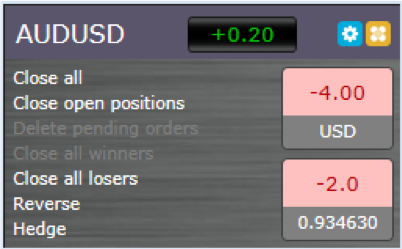

The EqualFX Market Manager provides a full overview of the account to the trader also shows key-market data in one small window.

The app provides the below functionalities:

Simply put the EqualFX Market Manager small window provides a gateway to all aspects of account management even with the MT4 platform being minimised (not closed). Like all other EqualFX apps, the EqualFX Market Manager window can be "always on top" so you can stay in control while using other programs on your computer such as a web browser.

The EqualFX Market Manager shares its order-entry settings and templates with all the other EqualFX trading apps. The quick-entry templates which you can create in the EqualFX Trade Terminal or EqualFX Mini Terminal, you can also use in the EqualFX Market Manager, which provides you two-click trading with even complex rules.

The EqualFX Mini Terminal is a smaller version of the EqualFX Trade Terminal, designed to focus on a specific market and displays the same deal ticket as the EqualFX Trade Terminal just in the context of a specific trading chart.

Its deal ticket offers you the following options:

Simply put the EqualFX Mini Terminal allows one-click entry for simple market orders and two-click entry for potentially-complex pre-defined templates. These templates can be used also in the EqualFX Trade Terminal and EqualFX Market Manager apps.

The EqualFX Sentiment Trader is based on real-time live sentiment data and allows traders to make decisions by assessing it.

Key features include:

You can use the sentiment information to verify your trading strategy/decisions

Some traders also can notice patterns in the sentiment changes and price movements and make trading decisions based purely on the sentiment alone.

Also, other options in the EqualFX Sentiment Trader app include:

Alarms on sentiment data

Please note that the sentiment data is also available in the EqualFX Alarm Manager app, which allows the investor to create alerts about the sentiment data and also set up automatic actions such as placing trades when a certain sentiment level surpassed.

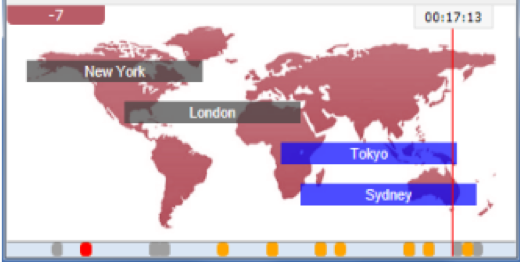

The EqualFX Session Map provides the traders with a quick overview of the markets, also the actual status of their account.

World markets

The app shows you a map of the main world markets and a representation of your local time. Moreover, the EqualFX Session Map includes several other useful features.

Economic calendar

The bar at the bottom of the EqualFX Session Map indicates future events in the economic calendar, colour-coded by the probable impact. You can get a summary of each event by hovering the mouse over the marker in the bar, also you can read the full overview by clicking on the marker.

Key market changes

The EqualFX Session Map also displays information about price movements in key markets during the current session or a previous one. For each of the major symbols, the app displays the following information about what has happened in the session so far :

Account data

To provide you more insight, the EqualFX Session Map also shows the status of your account. The world map is colour-coded depending on whether you are is in profit or loss and any floating P/L is shown in a marker at the top of the map. Clicking on this marker displays key account metrics: equity, balance, margin usage.

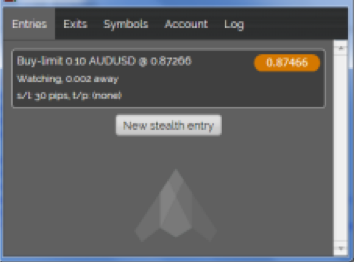

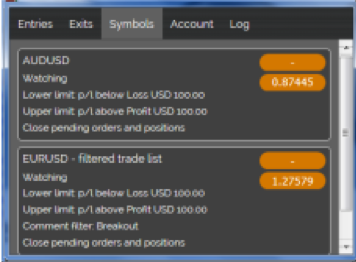

The EqualFX Stealth Orders app allows you to hide your pending orders from other market participants. Instead of placing a sell stop or buy limit order, the app waits for a price level to be hit and then buys or sells like a market order. The app also provides stealth stop-losses and take-profits, closing your positions when an exit price - or when a profit/loss - level is reached.

The app is not just a useful tool but also provides you with the reassurance that EqualFX is treating your orders with fairness and transparency, no intentional slippage also no stop-hunting, etc.

The EqualFX Stealth Orders app provides many features:

All stop-losses and take-profits can be specified in cash terms instead of prices: for example, "close this trade at +$50 profit or -$70 loss" instead of "close this trade at 1.4567 or 1.4321". The app also lets you set up trailing stops, again on a hidden stealth basis.

The symbol-exit and account-exit features are a useful facility for managing positions even if you are not interested in the stealth aspects of the app.

Account exits can provide a simple "emergency-break", closing all positions on the account if floating P/L or free margin becomes dangerously low - or if a profit target is hit.

The EqualFX Tick Chart Trader app is equipped with ultra-fast order entry and exit by single mouse-clicks or keyboard shortcuts also can show you multiple types of tick charts and. It is ideal for traders who want to place very short-term trades, entering and exiting the market rapidly several times in the course of a trading session.

The app provides five different tick-chart views for different styles of trader:

Market orders can be placed either by clicking on the ask or bid price or by using the keyboard shortcuts B and S. For ultra-fast order entry, the trader can choose to allow the Ctrl key to place orders without confirmation. Ctrl+click or a keyboard shortcut such as Ctrl+B then places an order instantly, without any confirmation or user interface pop-up.

The EqualFX Trade Terminal is a cutting edge trading and analytic tool equipped with various functions, designed to provide you trading features that are not available in the MT4.

Deal Ticket

The deal ticket offers the below functions:

In other words, the EqualFX Trade Terminal allows one-click entry for simple market orders, and two-click entry for potentially-complex pre-defined templates. These templates can also be saved and used in the EqualFX Mini Terminal and EqualFX Market Manager apps.

Account metrics

The EqualFX Trade Terminal gives an overview of the current metrics of your account, such as equity and margin usage, and an easy way to set up alerts on these figures - e.g. a warning if margin usage exceeds 10%

Position and order lists

The EqualFX Trade Terminal also shows a list of all your open positions and pending orders, with easy options to carry out actions such as the following:

You can select multiple orders from the list and then carry out actions on all of them at once. For example, select all your losing trades, and then set a break-even take-profit on those positions using only two mouse clicks.

Rules for scaling out of positions

The EqualFX Trade Terminal also allows you to define rules for scaling out of positions, and these rules are then applied automatically without further manual involvement. An example of such rules is as follows:

In the same way as the order entry rules, also these rules can be saved as templates and quickly applied to new positions in the future with a couple of mouse clicks.

Position analysis

The EqualFX Trade Terminal provides many possibilities for analysing your open trades. The positions can be grouped into categories, e.g. by symbol, or direction, or the combination of symbol and direction.

You can also see the total profit etc. for each category, and you can carry out actions on all the positions which fall into the same category, e.g. setting a 30-pip stop on all AUD/USD buy orders.